Deposit

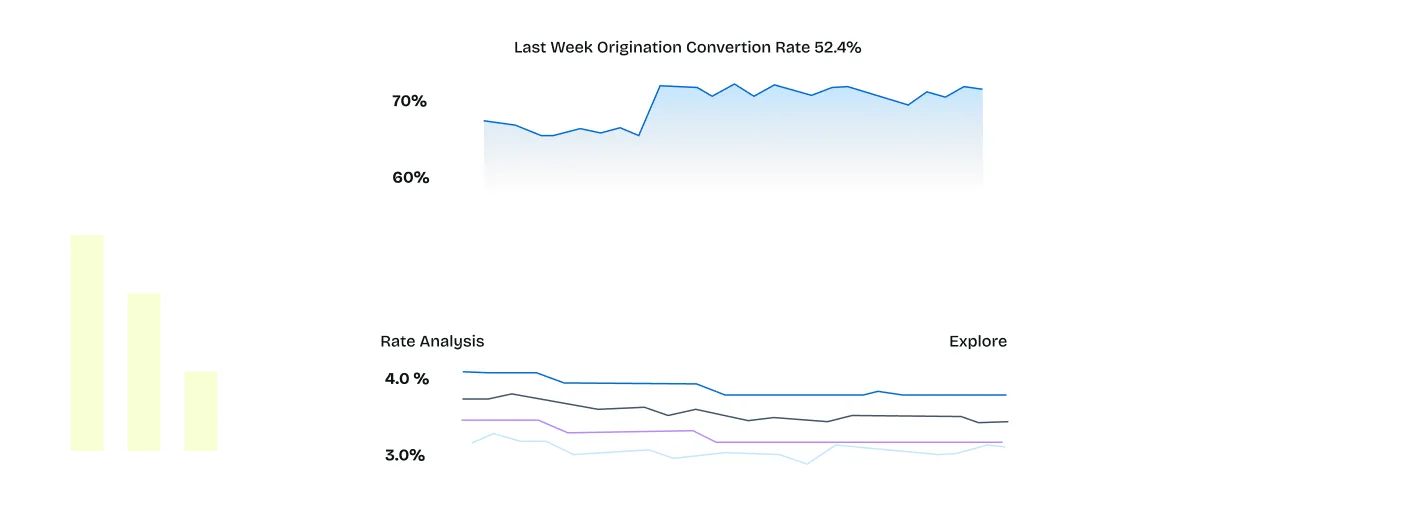

Portfolio Analytics

Unlock real-time insights for banking performance. Transform data into strategic decisions with precision and speed.

Technology

Intelligent platform for modern financial institutions

Our technology cuts through complexity with razor-sharp precision. We deliver actionable insights that drive strategic decision-making.

50%

Faster decision making for financial institutions

50%

Increased accuracy in deposit portfolio management

Features

Powerful capabilities for strategic lending

Unlock the potential of data-driven banking solutions.

Customer insights

Tailored solutions for diverse financial institutions to optimize their lending strategies.

Learn moreCustomer insights

Tailored solutions for diverse financial institutions to optimize their lending strategies.

Learn moreCustomer insights

Tailored solutions for diverse financial institutions to optimize their lending strategies.

Learn moreImpact

Drive growth and efficiency

Transform your lending strategy with intelligent, data-driven solutions.

Schedule a demo

Learn how top financial institutions use Nomis to drive results. Book your personalized demo today.