Nomis Price Manager

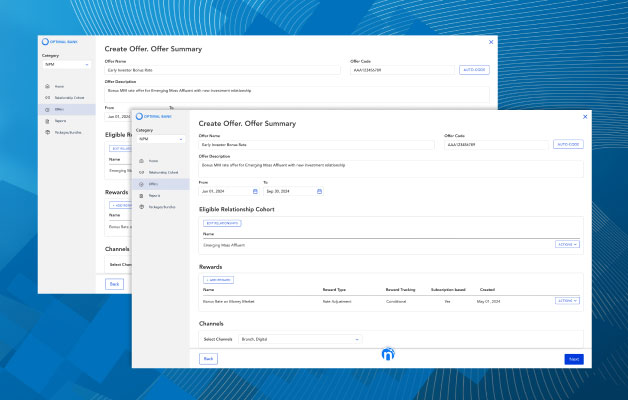

Nomis Price Manager makes it easy to attract, retain, and grow customer relationships through targeted pricing campaigns and offers.

Nomis Price Manager makes it easy to implement customer-centric pricing strategies, without the complexities and unavoidable risks of manipulating legacy systems. By removing the barriers of legacy systems, banks can focus on what matters the most: reducing friction and deepening customer relationships, with innovative pricing.