NOMIS PRICE OPTIMIZER

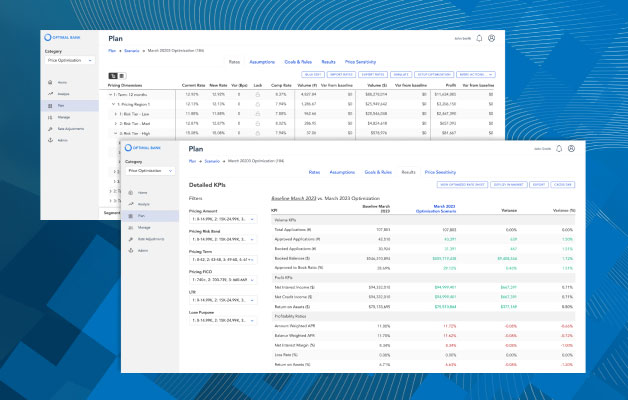

Nomis Price Optimizer creates a centralized hub for pricing intelligence, portfolio analytics, and rate optimization and planning tools.

A fundamental pillar of Nomis Solutions’ global, industry-leading technology platform, Nomis Price Optimizer answers the most critical question of portfolio price optimization: “What is the optimal price for my product in light of my strategic goals and constraints?”

Banks that leverage Nomis’ native pricing science and technology are better positioned to optimize rate sheets, discretion boundaries, promotional campaigns, and more.